Aug 23, 2024

2024 has been a tumultuous year for the cryptocurrency market. This cycle is being shaped by sharp fluctuations, political uncertainty, and the emergence of new narratives. Several key narratives are taking shape, driving both innovation and market sentiment. This article speaks to the performance of the market in 2024, so far, highlighting the top-performing narratives that have defined this year.

Market Overview: A Year of Contrasts

So far 2024 has been marked by significant volatility. The market experienced both remarkable highs and relatively deep pullbacks (20–30% on avg.). The notable month-over-month declines took place in June and April, where the market saw average declines of -23.7% and -26.8%, respectively. The market has also shown resilience, with positive performance streaks, from February to March, with 35.4% and 15.7% increases. We also saw a healthy recovery in May at 12% after the 27% decline in April.

Despite these fluctuations, several narratives have managed to outperform the broader market, driven by both technological innovation and shifting investor sentiment.

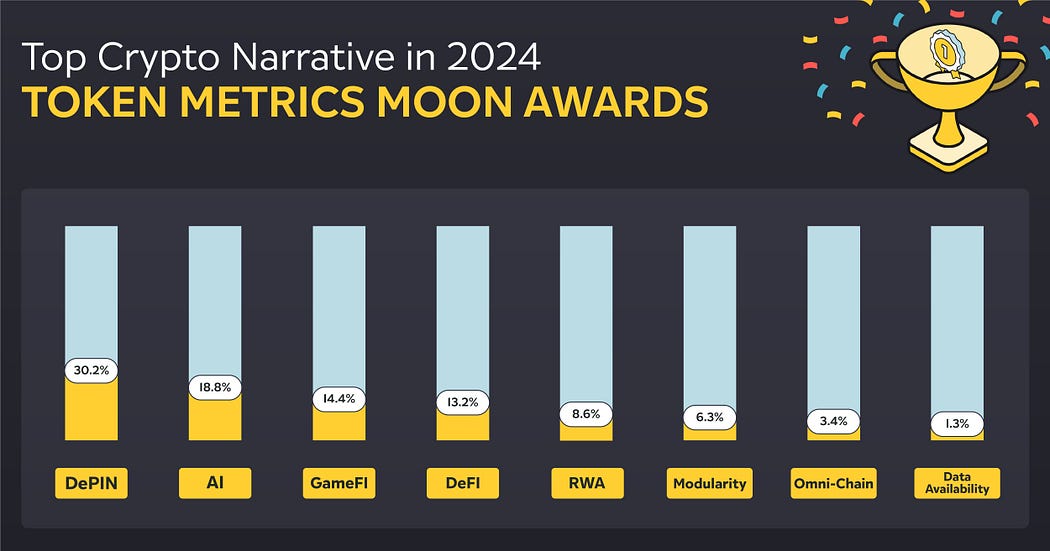

Top Performing Narratives of 2024

(Not in order)

Privacy: The Demand for Anonymity

Privacy-focused cryptocurrencies and technologies have consistently been among the top performers in 2024. With growing concerns about data security and governmental surveillance, the demand for privacy solutions has surged. In July, Privacy narratives led the market with a 22.2% increase, showcasing the enduring appeal of anonymity in the crypto space. The consistent interest in Privacy indicates that as the world becomes more digitized, the desire for secure and private transactions will continue to drive this narrative forward.

2. DeSci: Decentralized Science Takes Root

Decentralized Science or DeSci has emerged as a significant narrative in 2024, reflecting the increasing interest in decentralized research and data-sharing platforms. DeSci was one of the top-performing narratives in multiple months, including February (+60.3%) and July (+10.8%). This narrative is gaining traction as it promises to democratize scientific research, allowing for more transparent and open collaboration across borders. The consistent performance of DeSci highlights the potential for blockchain technology to revolutionize traditional industries beyond finance.

3. Memes: The Power of Community-Driven Projects

The Meme narrative has continued to capture the imagination of the crypto community. Often dismissed as a joke, meme coins, and related projects have proven their staying power in 2024, driven by strong community support and viral marketing. May was a standout month for Memes, with the narrative seeing a staggering 36.5% increase. The Meme narrative has taken 2024 by storm and has been the best-performing overall market Narrative with a mass 100,000% return yoy. This success underscores the influence of social media and community engagement in driving value within the crypto ecosystem.

4. Real World Assets: Bridging the Digital and Physical Worlds

Real World Assets, more commonly called RWAs, have gained considerable attention over the last few years. The concept of tokenizing physical assets like real estate, commodities, and intellectual property has become more mainstream. March saw the RWA narratives skyrocket with a 105.0% increase, making it the best-performing narrative of that month. Despite facing challenges in April and subsequent months, the overall trend for RWAs remains positive, as more investors recognize the potential for blockchain to unlock liquidity in traditionally illiquid assets.

5. Oracles: Connecting Blockchain with Real-World Data

Oracles, enable smart contracts to interact with real-world data. Building on the previous narrative of RWAs, oracles are essential to their success. In May, the Oracle narrative saw a 39.4% increase, feeding on the success of RWAs two months prior. The importance of Oracles cannot be overstated, as they are essential for the functionality of decentralized applications across various sectors, from finance to supply chain management. The continued growth of this narrative reflects the increasing reliance on blockchain technology for real-world applications.

Are Narratives Market Dependent?

Narratives That Shine in Up Markets

When the market is going up, speculative and growth-driven narratives tend to lead the charge. For instance, Memes consistently perform well during positive months, reflecting the market’s enthusiasm and speculative nature. The same can be said for Identity and AI narratives, which have shown strong performances during market upswings. These narratives are often fueled by speculation of technological advancements which triggers high investor interest, driving rapid price appreciation. RWAs have also show to perform well in positive months, highlighting a growing interest in tokenization, which is see to be adding tangible value to the crypto ecosystem. The success of these narratives in positive months suggests that they are driven by optimism, speculative innovation, and a forward-looking investment approach.

Narratives That Hold Strong in Down Markets

Conversely, during down markets, more defensive and utility-focused narratives come to the fore. Privacy and DeSCI are standout examples of narratives that tend to perform better during bearish periods. Similarly, DeSCI shows resilience in downturns, likely due to its underlying utility and long-term value proposition, which are less susceptible to speculative pressures. These narratives are typically backed by niche community support and practical applications that maintain their value even when the market at large is struggling.

Where to invest when?

Understanding which narratives perform in different market conditions allows investors to make more informed decisions. In bullish phases, leaning into high-growth, speculative narratives like Memes and Identity can yield substantial returns. However, in bearish conditions, reallocating to more defensive narratives like Privacy can help preserve capital and reduce exposure to market volatility. This balanced approach, incorporating both speculative and defensive narratives, can provide a robust strategy for navigating the crypto market’s inherent fluctuations.